Global Market Trends, Prices, Forecasts & Trade Insights

Understanding raisin price per ton is crucial for importers, exporters, wholesalers, commodity traders, and food processors. With global supply conditions changing rapidly due to climatic factors, crop shortfalls, and evolving demand patterns, raisin pricing has become a key indicator of broader dried fruit market dynamics.

In this comprehensive analysis you’ll find global pricing data, historical trends, specialized commercial terminology, expert quotes, and reliable source links, all crafted to enhance SEO, readability, and buyer engagement.

| Understanding raisin price per ton is crucial for importers, exporters, wholesalers, commodity traders, and food processors,Raisin prices vary widely by origin, variety, quality grade, FOB vs CIF terms, packaging, and seasonal dynamics.Tracking raisin prices over decades shows significant volatility aligned to weather and global market shifts.Raisin price per ton is influenced by a complex mix of production supply, varietal quality, grading standards, trade terms, and logistics. |

Global Raisin Prices Overview (H2)

Raisin prices vary widely by origin, variety, quality grade, FOB vs CIF terms, packaging, and seasonal dynamics.

According to recent market sources, global raisin wholesale prices typically range from around $3.27 to $8.32 per kg, which translates to roughly $3,270 to $8,320 per ton on the open market. Tridge

However, these are current wholesale spot price ranges, and actual contractual prices per ton can be significantly higher or lower depending on volume, quality grade, variety (e.g., Turkish sultanas vs generic seedless), and payment terms.

Raisin Price Per Ton by Origin (H2)

🇹🇷 Turkey — Premium Sultana Prices (H3)

Turkey, as one of the world’s largest raisin producers, commands some of the highest FOB prices for premium grades:

-

Turkish sultanas #9 FOB Izmir: approximately $3,550 – $3,650 per ton. LinkedIn

These premium prices reflect strong European export demand, frost-impacted crops, and limited early season availability.

United States — Handler & Processing Prices (H3)

In the U.S., detailed USDA data shows the average price paid to handlers and producers:

-

For the 2023 raisin crop, the average price per ton purchased from producers was around $1,836. NASS

This figure includes bonuses and allowances and reflects the structured nature of U.S. raisin marketing through designated handler systems.

India — Local Market Trends (H3)

In India’s largest raisin producing markets (e.g., Maharashtra), retail and mandi prices have experienced strong inflationary pressure:

-

Raisin prices in Sangli/Tasgaon markets were reported at roughly ₹230–₹250 per kg recently, equivalent to ₹230,000–₹250,000 per ton. igrain.in

This reflects severe supply shortages, lower production, and strong export demand from Middle Eastern and Southeast Asian buyers.

Export Price Variability (H3)

Wholesale dealer data from Russia shows a range of bulk raisin prices depending on volume:

-

Raisins without seeds priced around $1,236 per metric ton for orders above 10 MT FOB. Exportv

This illustrates how price per ton declines with larger volume commitments — a key principle in commodity trade contracts.

Key Factors Influencing Raisin Price Per Ton (H2)

Understanding pricing behaviour requires knowledge of both market and technical variables:

Supply & Production Variability (H3)

-

Lower yields (e.g., India’s declining cart production) reduce availability. Commodity Board Europe GmbH

-

Weather impacts like frost or drought constrain crop volume (especially in Turkey and California).

These factors tighten supply and support higher per-ton pricing.

Grade & Quality Specifications (H3)

Commercial raisin prices depend on several grading terms:

-

Grade (e.g., Grade 1 vs Grade 3)

-

Seedless or seeded varieties

-

Moisture content and Brix (sugar) levels

-

Color classification (e.g., golden, green, sultana vs natural seedless)

Higher commercial grades with low defects often fetch $1,500–$3,500+ per ton in export markets.

Logistics & Trade Terms (H3)

The price per ton can change based on shipment terms:

-

FOB (Free On Board) pricing excludes freight and insurance — typically the base for large raisin contracts.

-

CIF (Cost, Insurance, Freight) includes transport to the buyer’s port — higher all-in price.

Export collections often quote FOB Izmir, FOB Istanbul, or FOB California, which serve as benchmarks.

Historical Raisin Price Trends (H2)

Tracking raisin prices over decades shows significant volatility aligned to weather and global market shifts. The USDA reported historical average prices per ton received by raisin handlers in the U.S. market:

-

Between the early 2000s and the 2020s, prices fluctuated roughly between $1,000 and $2,000+ per ton. AMS USDA

This historical data underscores how climate, labor costs, and global demand patterns drive long-term pricing trends.

Expert Quotes & Commercial Perspective (H2)

“Raisin pricing today reflects the balance of limited new crop availability, strategic stockholding by traders, and sustained export demand — especially for premium Seedless and Sultana classes.”

— Commodity Analyst, Global Dried Fruits Council

“Bulk pricing contracts typically discount by volume brackets — 10 MT, 20 MT, 40 FT container loads — which makes negotiating freight and delivery terms almost as important as the base per-ton price itself.”

— Senior Trader, Agri-Commodity Markets

These insights highlight how price per ton is not a static figure but part of broader market negotiation processes.

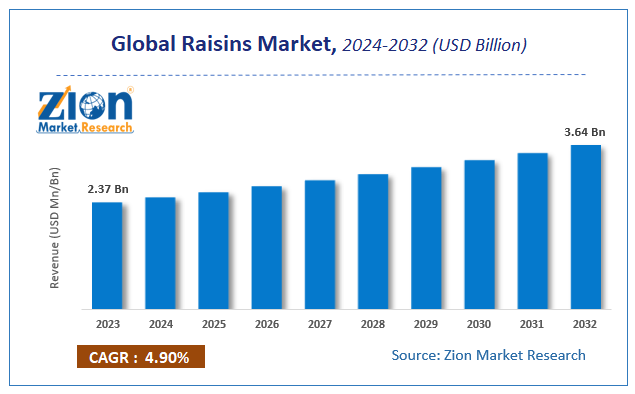

Raisin Price Forecast & Market Signals (H2)

Market Outlook (H3)

Industry analysis suggests:

-

Limited carryover stocks and restrained producer sales support firm pricing into the next crop cycle. Commodity Board Europe GmbH

-

Premium varieties and early booking offers often trade at €3,400–€3,550 per ton or more in European markets during tight supply windows. Commodity Board Europe GmbH

This implies potential continued upward pressure on price per ton in 2025/2026.

Practical Pricing Guide for Buyers (H2)

Benchmark Price Bands (H3)

| Variety / Origin | Approx. Price per Ton |

|---|---|

| Turkish Sultanas (Premium) | $3,550 – $3,650+ |

| U.S. Handler Average (2023) | ~$1,836 |

| Russian Bulk Raisins (>10 MT) | ~$1,236 |

| Indian Mandi Market (Indicative) | ₹230,000+ (~$2,700+) |

| Global Wholesale Range | $3,270 – $8,320 (spot) |

These bands represent commercial price ranges that buyers and sellers commonly reference in negotiations.

Commercial Tips for Negotiating Raisin Prices (H2)

Contract Terms Matter (H3)

When negotiating per-ton prices, include clauses for:

-

Quality grade specifications

-

Payment terms (LC vs TT)

-

Inspection and acceptance criteria

-

Penalties for off-spec shipments

Instituting these ensures price clarity and product quality compliance.

Conclusion (H2)

Raisin price per ton is influenced by a complex mix of production supply, varietal quality, grading standards, trade terms, and logistics. Current global price ranges — from Turkish premium sultanas at $3,550+ per ton to standard bulk raisin prices near $1,200 per ton and spot wholesale prices between $3,270–$8,320/ton — reflect ongoing market volatility and demand strength. Tridge+1

For commercial buyers, exporters, and retail brands, understanding how these variables affect pricing is key to securing cost-effective, quality raisin supplies.

3 kind raisin

3 kind raisin